Product Overview

The Electrum QR Payment Service allows retailers to initiate merchant-presented QR code consumer payments in busy, multi-lane retail environments. The service acts as a tag aggregator, enabling the initiation, authorisation, and finalisation of both open and closed-loop payments through a single interoperable QR code based on PASA standards.

This approach allows retailers to support multiple payment options using one interoperable merchant-presented QR code. As a result, retailers can offer their customers convenient payment methods, including Scan to Pay, closed-loop wallets (like Cryptocurrency and loyalty), or PayShap.

Electrum can generate QR codes upon request from a POS system. Electrum receives notifications from partners when their QR codes are scanned and links payment requests from POS systems with the corresponding scan notifications to ensure that the payment request goes to the correct partner.

High-level Architecture

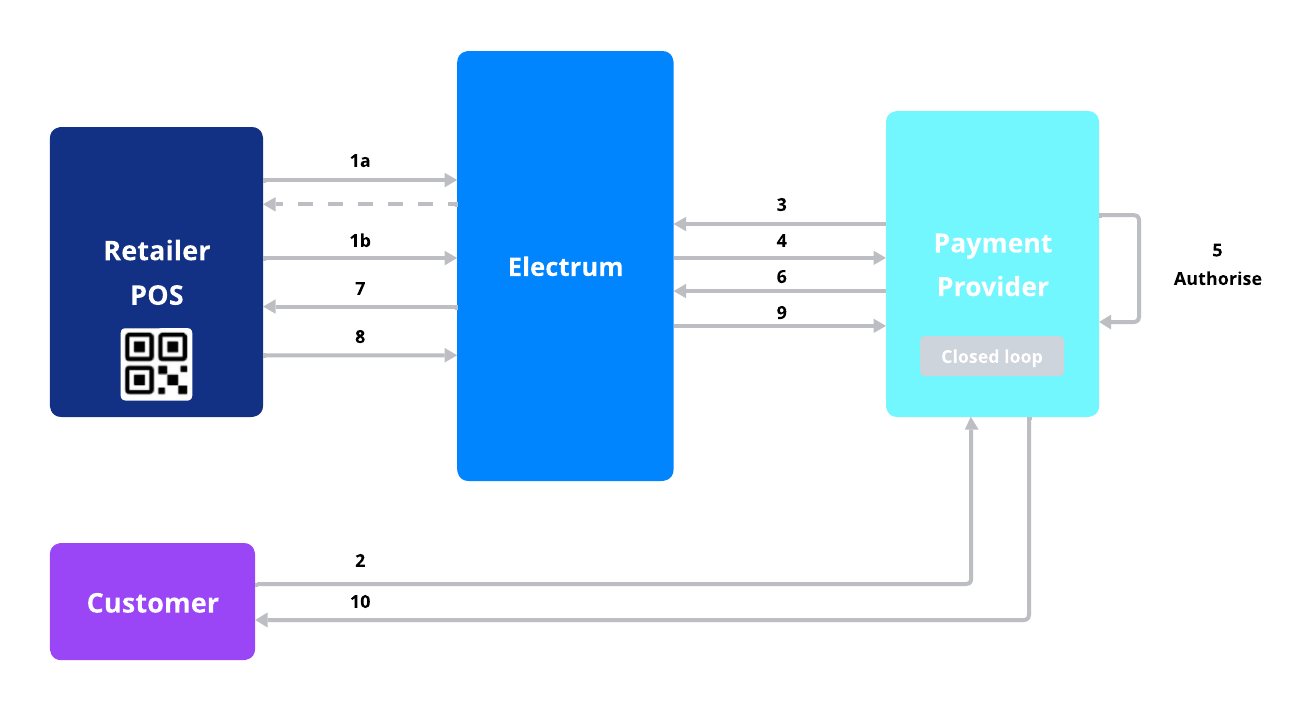

The diagram and descriptions below explain how QR transactions are implemented.

Steps 1a and 1b take place simultaneously.

1a. The customer wants to pay with a QR code and the retailer requests a QR code from Electrum. Electrum generates a QR code which is returned to the retailer POS device to be displayed on the pin entry device (PED).

1b. The retailer’s POS simultaneously sends a payment request to Electrum and initiates the payment.

The customer scans the QR code and submits it through the app to the payment provider.

Electrum receives a scan notification from the payment provider.

Electrum matches the notification from the payment provider with the payment request received from the retailer and routes the authorisation request to the payment provider.

The payment provider authorises the payment; this may also involve customer consent.

The payment provider response is sent back to Electrum.

Electrum forwards the response to the retailer.

The retailer finalises the transaction and forwards the advice to Electrum via a store-and-forward (SAF) queue.

Electrum sends the confirmation advice or reversal advice message to the payment provider.

The payment provider notifies the customer whether the transaction was successful or failed.

Payment Providers

Electrum has integrations available for:

| Service Providers | Type of Service |

|---|---|

| Scan to Pay (Masterpass) | Contactless credit card transactions |

| Crypto Convert | Closed loop wallets |

Electrum QR service support many different payment providers. Reach out to our partnerships team if you would like to explore additional providers.

Electrum Finance and Reconciliation

Electrum Finance is a collection of tools to facilitate the reconciliation of transaction records between multiple parties, the calculation of principal settlement amounts and fees, and the generation of reports required for finance processes.

Security

We will secure all communication by establishing an TLS-encrypted (Transport-Layer Security, an updated and more secure form of SSL) connection. TLS enables client and server systems to identify each other and creates an encrypted channel for secure communication. This technology provides security at the network level while verifying the identities of the entities involved in communication.